360 degree discretionary portfolio management

Our core services

Wealth Planning

Jurisdictional diversification

Structures and services related to tax, inheritance, asset protection and compliance

Access to our network of partners to provide full suite of wealth planning solutions

Investment Strategy

Portfolio performance reviews and consultation

Tailor-made proposals

Formulation of suitable investment mandate

Reporting

Get online statements and performance reports efficiently and securely.

Reporting across multiple banks.

Ongoing account monitoring and reviews

Investing

Hybrid investment process and methodology.

Research and investment strategies from multiple private banks

Discretionary investment organizer

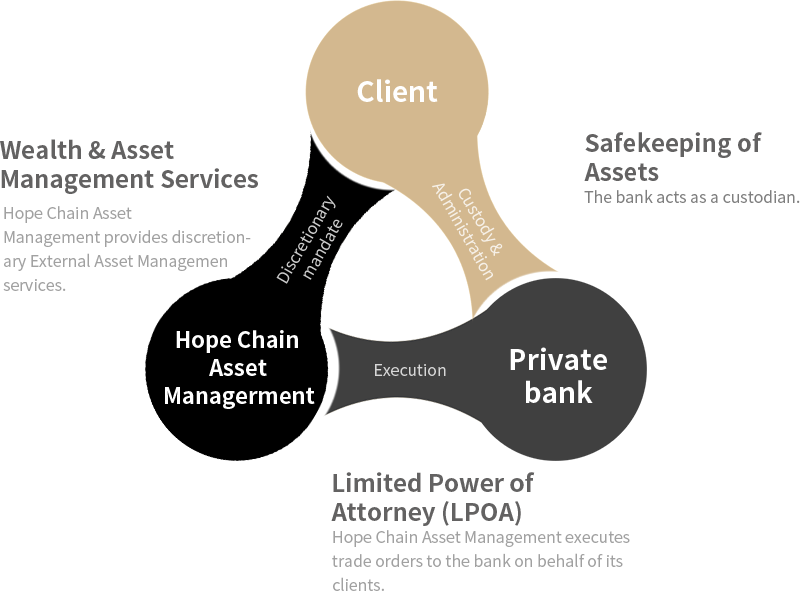

Structure of the EAM model

Our core services

Bank Account Opening

A direct relationship established between client and one of our partner banks. HCAM assists the account opening procedures.

Mandate Management

HCAM manages, on a Discretionary basis, the investment mandate which is suitable for and agreed with the relevant client.

Limited Power of Attorney

Client gives HCAM a LPOA status of the account which allows us to buy and sell assets. Such LPOA status can be removed at client's discretion at any time.

Custodian

The banks acts as a custodian, while client still retains full ownership and control of their assets.

Monitoring & Balance

This tri-party relationship allows on-going checks and balance,keeping control of client's assets at all times. Custodian banks will provide reporting services.

Our strengths

Our core services

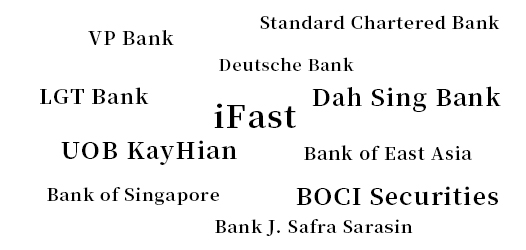

Our partners

Hope Chain Asset Management

After fact finding and need analysis.

Our Clients

Based on the team's knowledge and expertise in the industry.

We filter and recommend most suitable service provider to our clients.

Using Hope Chain Asset Management vs Direct to bank

Our core services

Using Hope Chain Asset Management

· Multiple providers to suit different needs

· Variety of products (avoid product pushing)

· Multiple research providers

· Two governing bodies meaning double protection for clients

Private banking and products

· Single provider

· Limited product range

· One governing body (HKMA)